Working in a dynamic city like Dubai offers amazing opportunities, but what if you suddenly find yourself without a job? The UAE government introduced a plan to support you during such times.

The benefits of ILOE insurance act as a financial safety net, giving you income security if you face an involuntary job loss. This program, known as the Involuntary Loss of Employment insurance, is designed to provide you with money for a limited time for reasons outside of your control.

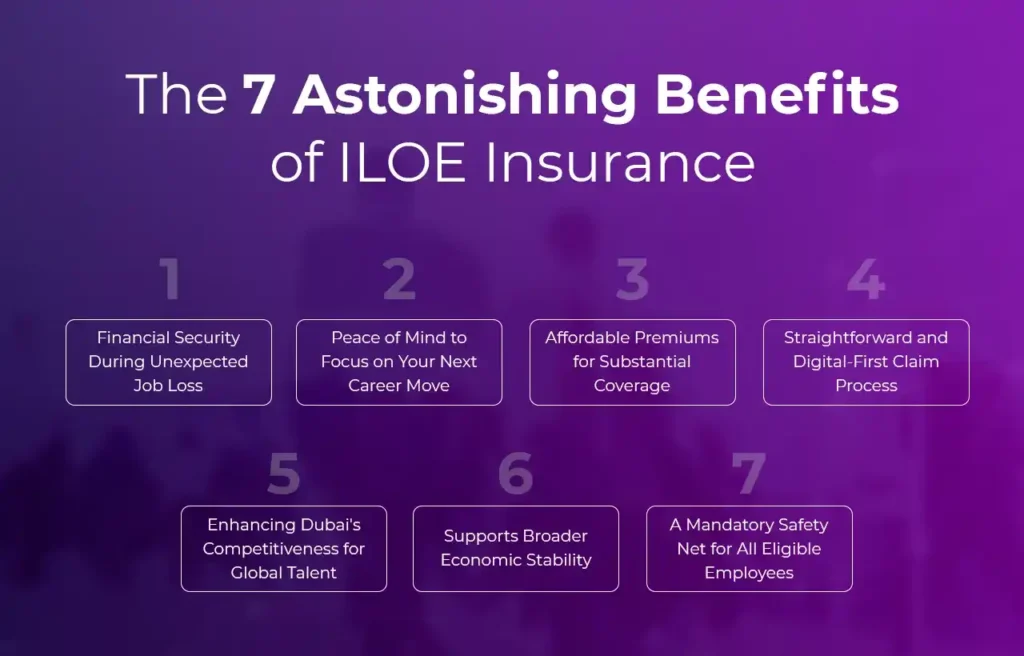

Let’s explore the seven main advantages, see how it operates, and check who is eligible for this mandatory coverage.

What is ILOE Insurance?

ILOE Insurance, or Involuntary Loss of Employment Insurance, is a government-backed program in the UAE. It acts as a financial support system for employees in both private companies and the federal sector if they lose their job for reasons they couldn’t control. Think of it as a safety net that provides you with temporary income. This unemployment insurance scheme gives you a sense of security while you are between jobs.

The program’s primary advantage is the monthly cash payment it offers. You can receive an amount equal to 60% of your average basic salary, which is calculated from the last six months of your employment. This support is provided for up to three consecutive months for a single claim, helping you manage your finances during your job search.

The insurance plan is divided into two categories based on your monthly basic salary:

Category A: If your basic salary is AED 16,000 or less, you fall into this group. The highest monthly compensation you can get is AED 10,000.

Category B: This is for you if your basic salary is more than AED 16,000. The maximum monthly compensation here is AED 20,000.

This system is designed to give you a financial cushion. It helps you cover necessary expenses like rent and daily needs, allowing you to focus on finding a new job without immediate financial stress.

The 7 Astonishing Benefits of ILOE Insurance

1. Financial Security During Unexpected Job Loss

Losing your job unexpectedly can create a lot of financial stress. The primary advantage of the ILOE insurance scheme is the financial support it provides when you need it most. This program acts as a direct safety net, giving you a temporary income to help cover essential living expenses like rent, utilities, and groceries.

This income protection helps you and your family maintain your lifestyle without the immediate need to dip into your personal savings or take out loans. The financial support from the job loss insurance gives you stability and peace of mind, allowing you to focus on your search for a new job without the constant worry about daily expenses.

2. Peace of Mind to Focus on Your Next Career Move

Searching for a new job is a job in itself, and it can be stressful when you’re worried about money. This is where the unemployment insurance scheme truly helps.

By providing a temporary income, it removes the immediate financial pressure you might feel. This support gives you the breathing room to find a new position that truly fits your skills and career goals, instead of accepting the first offer that comes along out of desperation.

When you aren’t constantly anxious about paying your bills, you can focus your energy on preparing for interviews and finding the right opportunity. This reduction in stress is a huge benefit for your mental well-being, helping you stay positive and confident during your job search.

3. Affordable Premiums for Substantial Coverage

One of the best features of the job loss insurance program is its affordability. The plan is designed so that every eligible employee can easily access its financial support without a heavy cost. The premiums are very low, making this income protection accessible for everyone working in the UAE.

The cost is based on your salary category:

Category A Premium: If your basic salary is AED 16,000 or less, you pay only AED 5 per month, plus VAT.

Category B Premium: If your basic salary is more than AED 16,000, you pay AED 10 per month, plus VAT.

This low monthly payment makes the unemployment insurance scheme an excellent value for the coverage it provides. It’s an affordable safety net for all employees, whether you are an expatriate or a UAE national.

4. Straightforward and Digital-First Claim Process

When you are dealing with a job loss, you don’t want to face a complicated claims process. The ILOE insurance scheme makes applying for your benefits simple and stress-free. The entire claim process is designed for your convenience and is handled online.

You can easily submit your claim through the official ILOE portal or its mobile app. This digital approach means you can complete your application from home without needing to handle complex paperwork. Because the system is efficient, claims are processed quickly, and once approved, your compensation is paid promptly. This helps you get financial support when you need it most, without unnecessary delays.

5. Enhancing Dubai’s Competitiveness for Global Talent

Dubai is a major hub for professionals from all over the world, and the ILOE insurance scheme makes it an even more appealing place to build a career. This job loss insurance provides a level of social security that you would find in many other developed countries. It sends a clear message to international professionals that their well-being is valued.

For expatriates, this income protection offers assurance that they will have support during uncertain times, making the UAE a more attractive long-term destination. This helps Dubai attract and keep the best talent from around the globe, strengthening its position as a leading business center.

6. Supports Broader Economic Stability

The ILOE insurance program does more than just help individuals; it supports the entire economy. When people unexpectedly lose their jobs, they often reduce their spending, which can slow down economic activity. By providing a temporary income to unemployed individuals, the scheme helps maintain consumer spending on essentials like groceries and bills.

This continuous flow of money helps businesses stay afloat and supports overall economic resilience, especially during economic downturns when job losses might be more frequent. The unemployment insurance plan fosters a more stable economic environment by lessening the financial shock of job loss on families and the broader community.

7. A Mandatory Safety Net for All Eligible Employees

A key feature of the ILOE program is that it is a mandatory safety net for most employees. As of January 1, 2023, subscribing to this job loss insurance became a requirement for nearly all employees in the private and federal government sectors.

This requirement also extends to employees working in UAE free zones, making sure there is widespread protection across the entire workforce. Because the scheme is mandatory, it creates a large, shared pool of resources that makes the labor market more secure for everyone. This ensures every eligible person has access to income protection, strengthening the social security system in the UAE.

How Does ILOE Insurance Work? A Look at Eligibility and Exclusions?

To make the most of the job loss insurance, you need to know if you qualify and what situations are covered. The rules are clear and help you understand how this income protection works.

Who is Eligible?

You can get support from the ILOE scheme if you meet a few conditions.

- You work for the federal government or a private company.

- You have been subscribed to the insurance plan for at least 12 consecutive months.

- Your subscription payments are all paid and up to date.

- You lost your job for a reason you couldn’t control, such as the company downsizing or restructuring. The benefits do not apply if you resign or are dismissed for disciplinary reasons.

Who is Not Eligible?

Some groups of people are not covered by this unemployment insurance scheme. You are not eligible if you are:

- An investor or the owner of the company you work for.

- A domestic helper.

- A temporary-contract worker.

- An employee younger than 18 years old.

- A retiree who receives a pension and has started a new job.

Frequently Asked Questions (FAQs)

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [{ “@type”: “Question”, “name”: “What is the maximum benefit I can receive from ILOE insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “You can receive up to AED 10,000 per month for Category A and up to AED 20,000 per month for Category B, for a maximum of three months per claim.” } },{ “@type”: “Question”, “name”: “How long do I need to be subscribed to claim benefits?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “You must be subscribed to the plan for at least 12 consecutive months before you can make a claim for an involuntary job loss.” } },{ “@type”: “Question”, “name”: “What are the main benefits of ILOE insurance for expatriates?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The main benefits of ILOE insurance for expatriates are financial stability and peace of mind, which provide a safety net in a foreign country during unemployment.” } },{ “@type”: “Question”, “name”: “Can I claim ILOE if I resign from my job?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “No, the program only covers involuntary loss of employment. You are not eligible for compensation if you resign from your position.” } },{ “@type”: “Question”, “name”: “Is ILOE insurance mandatory for employees in UAE free zones?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, subscribing to the ILOE insurance program is mandatory for all eligible employees in the private sector, and this includes those working in UAE free zones.” } }] }What is the maximum benefit I can receive from ILOE insurance?

You can receive up to AED 10,000 per month for Category A and up to AED 20,000 per month for Category B, for a maximum of three months per claim.

How long do I need to be subscribed to claim benefits?

You must be subscribed to the plan for at least 12 consecutive months before you can make a claim for an involuntary job loss.

What are the main benefits of ILOE insurance for expatriates?

The main benefits of ILOE insurance for expatriates are financial stability and peace of mind, which provide a safety net in a foreign country during unemployment.

Can I claim ILOE if I resign from my job?

No, the program only covers involuntary loss of employment. You are not eligible for compensation if you resign from your position.

Is ILOE insurance mandatory for employees in UAE free zones?

Yes, subscribing to the ILOE insurance program is mandatory for all eligible employees in the private sector, and this includes those working in UAE free zones.

A Final Thought

The ILOE insurance program is more than just a policy; it is a supportive pillar of Dubai’s employee-focused economy. Its main advantages are clear: it provides financial security when you lose your job, gives you peace of mind to find a new role, and contributes to the city’s overall economic stability.

This job loss insurance empowers you to manage your career in Dubai with greater confidence, knowing there is a support system in place for you during unexpected changes.