Did you know that over 85,000 Indian entrepreneurs have already established their companies in Dubai? If you’re wondering how to start a business in Dubai from India, you’re in the right place. Dubai offers amazing benefits like zero personal income tax, a strategic location connecting Asia and Europe, and business-friendly policies that make company registration simple.

This guide gives you a complete step-by-step roadmap for 2025. We’ll cover everything you need to know about Dubai business setup – from choosing between free zone and mainland companies to understanding the latest tax laws, visa processes, and post-setup compliance requirements specifically designed for Indian nationals looking to establish their Dubai company formation successfully.

How to Start a Business in Dubai from India? A Step-by-Step Guide

Step 1: Finalize Your Business Activity and Legal Structure

Your first step involves selecting a specific business activity from the Department of Economy and Tourism’s approved list. This choice affects your licensing requirements, costs, and operational permissions. You can’t just say “trading” – you need to specify exactly what you’ll trade, like “trading in electronics” or “import and export of textiles.”

Next, choose between three main legal structures for your company formation in Dubai. Mainland companies let you trade anywhere in the UAE but may require local partnerships. Free Zone entities offer 100% foreign ownership with tax benefits but limit your trading scope. Offshore companies work best for international business and asset protection but can’t operate within the UAE market.

Step 2: Choose and Register Your Company Name

Your company name must follow UAE regulations strictly. Avoid religious references, political terms, or offensive language. For sole proprietorships, you must include your full legal name in the company name. The name should reflect your business activity and include the legal structure (like LLC, FZE, or FZCO).

Check name availability through the relevant authority – Department of Economy and Tourism for mainland companies or your chosen free zone authority. Submit three name options as your first choice might already be taken. Once approved, you’ll receive a name reservation certificate that’s valid for a specific period, usually 30 days.

Step 3: Compile All Required Documents

Preparing your UAE company registration documents properly saves time and prevents delays. Here’s your complete checklist for business setup in Dubai:

- Passport copies of all shareholders and directors (must be valid for minimum 6 months)

- Visa copies if you’re already a UAE resident

- Emirates ID copy for current UAE residents

- Business plan outlining your operations and financial projections (required by certain free zones)

- Memorandum of Association (MOA) and Articles of Association (AOA)

- Attested proof of address and bank reference letters from your Indian bank

- Passport-size photographs for your application file

- No Objection Certificate (NOC) from current sponsor if you’re a UAE resident

- Make sure all documents are properly attested by the UAE Consulate or Ministry of Foreign Affairs before submission.

Step 4: Apply for Your Business License and Get Initial Approval

Once your documents are ready, submit your application to the Department of Economy and Tourism (DET) for mainland companies or your chosen free zone authority for Dubai free zone company setup. The application process takes 3-7 working days for most business activities.

Initial Approval is your first official permit that confirms the government accepts your business activity and structure. This approval allows you to proceed with securing office space and opening bank accounts. The Dubai government issues this certificate after reviewing your trade license application and verifying all submitted documents. You’ll receive a pickup date once your application is processed.

Step 5: Secure an Office Space (If Necessary)

Your trade license requires a registered address. Mainland companies must lease at least 200 sq ft of physical office space, while many free zones allow virtual offices or flexi-desks starting from AED 5,000/year.

Virtual office plans include mailing addresses and meeting room access. Flexi-desks offer shared workstations and visa quotas based on package.

If you need a dedicated workspace, commercial offices range from AED 20,000–AED 50,000/year depending on location and fit-out. Choose your option based on budget, visa needs, and business-scope restrictions tied to your company formation in Dubai.

Step 6: Final Submission, Fee Payment, and License Issuance

Once your MOA/AOA is signed by partners, submit the signed documents and name reservation certificate to the Department of Economy and Tourism or your free zone authority. Pay license, registration, and government fees—typically AED 12,900–AED 30,000 for free zones and AED 25,000–AED 60,000 for mainland setups.

Processing takes 3–7 working days. After approval, collect your original trade license and corporate documents. This license legally authorizes your entity to operate in Dubai.

Step 7: Open a Corporate Bank Account and Process Visas

With your trade license in hand, choose a bank—Emirates NBD, ADCB, HSBC or digital options like Wio. Prepare documents: trade license, MOA/AOA, shareholder passports, visa copies and proof of address. Account setup can take 2–4 weeks.

Simultaneously, apply for investor or employee visas through your jurisdiction’s e-portal. Investor visas grant residency for up to three years, while employee permits require labour approval and medical tests. Once stamped in your passport, you’re ready to hire staff and start operations in Dubai.

Source: The information presented here is based on official Dubai government guidance and expert insights from Invest in Dubai, as reflected in the cited sources.

Mainland vs. Free Zone vs. Offshore: Which is Right for Your Business?

Choosing the right company structure for your Dubai business setup from India affects everything from ownership rights to tax obligations. Each option serves different business goals and market strategies.

Dubai Mainland Company

Pros: Mainland companies offer complete freedom to trade anywhere in the UAE and internationally without restrictions. You can access government contracts, serve local clients directly, and choose from over 3,000 business activities. Recent law changes allow 100% foreign ownership in most sectors.

Cons: Higher setup costs ranging from AED 25,000-60,000 and mandatory physical office space of at least 200 sqft. Some professional licenses still require a Local Service Agent (LSA) arrangement.

UAE Free Zone Company

Pros: Free zones provide 100% foreign ownership, 0% corporate tax on qualifying income, and full profit repatriation. With over 50 specialized free zones, you get access to industry-specific ecosystems and simplified setup processes. Import/export duty exemptions apply within zones.

Cons: Trading restrictions limit business to the free zone and international markets – no direct UAE mainland trading allowed. Each free zone has specific activity limitations and compliance requirements.

Offshore Company

Pros: Perfect for international trade, asset protection, and tax optimization strategies. Offshore entities can maintain corporate bank accounts and operate with complete confidentiality. No corporate or personal income tax applies.

Cons: Prohibited from conducting any business activities within the UAE market. Cannot maintain physical offices in the UAE and must operate through registered agents only.

At-a-Glance Comparison Table

| Criteria | Mainland | Free Zone | Offshore |

| Ownership | Up to 100% foreign (activity-dependent) | 100% foreign ownership | 100% foreign ownership |

| Business Scope | UAE-wide + international trading | Zone + international only | International trading only |

| Office Requirement | Minimum 200 sqft physical office | Virtual/flexi-desk options available | No physical presence allowed |

| Visa Eligibility | Investor and employee visas | Investor and employee visas | No visa eligibility |

| Auditing | Annual audit required | Simplified audit requirements | Minimal reporting requirements |

The Real Cost of Setting Up a Business in Dubai

Breakdown of One-Time Setup Costs

Trade License Fee forms the biggest expense for your Dubai business setup from India. Mainland companies start from AED 25,000-30,000, while free zone licenses range from AED 9,000-15,000. Popular free zones like IFZA and Meydan offer competitive packages starting around AED 11,900-12,500.

Initial Approval & Registration Fees typically cost AED 2,000-5,000 depending on your business activity and legal structure. This covers your name reservation, initial approval certificate, and basic registration with the Department of Economic Development or your chosen free zone authority.

Notarization and Attestation Fees for legalizing your Indian documents through the UAE Consulate or Ministry of Foreign Affairs usually cost AED 1,500-3,000. These fees cover passport attestation, educational certificates, and business plan documentation required for your UAE company registration.

Additional one-time costs include Memorandum of Association drafting (AED 1,000-2,000) and government processing fees that vary by jurisdiction.

Breakdown of Ongoing Annual Costs

License Renewal is a mandatory annual expense that cannot be skipped. Mainland licenses cost AED 10,000-20,000 yearly, while free zone renewals range from AED 10,000-50,000 depending on your zone and business activities.

Office Rent varies dramatically in 2025. Flexi-desk options start from AED 5,000-15,000 annually, while small physical offices range from AED 30,000-50,000 per year. With Dubai office rents rising 45% in 2025, prime locations now average $148.90 per square foot annually.

Visa Costs include investor visas (AED 3,000-5,000 each), employee visas (AED 2,500-4,000), and dependent visas (AED 1,500-2,500 per person). Most companies need 2-3 visas initially, adding AED 8,000-15,000 to annual costs.

PRO Services and Compliance Fees cover VAT registration (AED 500-1,000), ESR/UBO filings (AED 2,000-3,000), and general PRO assistance (AED 800-1,150 monthly). These services handle government paperwork and keep your Dubai company formation compliant with UAE regulations.

Navigating Legal & Financial Compliance in 2025

UAE’s 9% Corporate Tax

The UAE charges 0% corporate tax on profits up to AED 375,000. For profits above AED 375,000, a 9% rate applies, based on Federal Decree-Law No. 47 of 2022 and further amendments up to 2025. This law pushes UAE companies to file tax returns for financial years starting June 1, 2023, or later.

However, “Qualifying Free Zone Persons” (QFZPs) may continue paying 0% on qualifying income if they meet strict substance, activity, and reporting criteria, but must file annual tax returns. Large multinational groups also face new “Domestic Minimum Top-Up Tax” rules from January 2025.

The India-UAE Double Taxation Avoidance Agreement (DTAA)

India and the UAE have a strong DTAA to make sure you’re not taxed twice on the same income. Under this agreement, if you pay tax on business profits, dividends, interest, or royalties in one country, you can claim a tax credit or pay a lower tax rate in the other.

The dividend tax is often capped at 10%, and interest income at 5% for cross-border payments. Capital gains on property are taxed where the property sits, while other gains (like shares) are usually taxed at your place of residence.

The DTAA also defines “Permanent Establishment”—if your Dubai company has significant operations in India, you could face tax in both places. But the agreement actively prevents double taxation and promotes transparent financial reporting.

RBI & FEMA Compliance: A Checklist for Indian Investors

When you start a business in Dubai from India, India’s RBI rules matter as much as UAE’s. The Outward Direct Investment (ODI) framework under FEMA lets Indian residents or companies invest in foreign businesses.

Before investing, you must file a Form ODI with an Authorized Dealer (AD) bank and receive a unique identification number. You have to submit an Annual Performance Report (APR) every year to keep the RBI informed about your business abroad.

Watch out: any past non-compliance or reporting gaps must be fixed by August 25, 2025, or the RBI may block all new overseas investments or start enforcement action. Make sure the FLA (Foreign Liabilities and Assets) annual return is filed in time too.

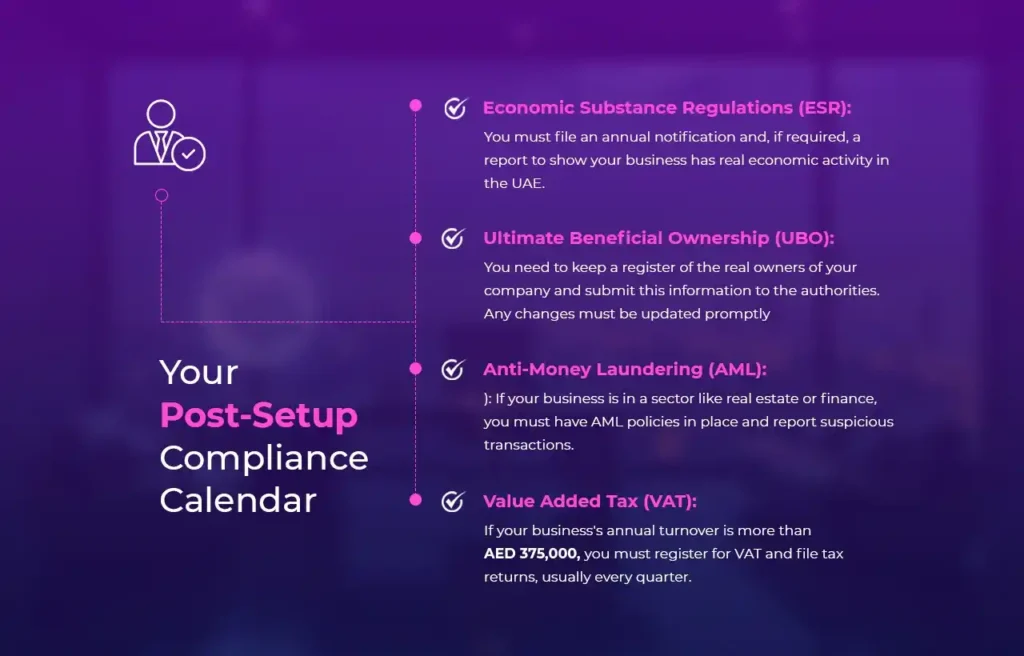

Your Post-Setup Compliance Calendar

Once your Dubai business is running, keep up with these annual tasks:

Economic Substance Regulations (ESR): Submit annual notifications and full reports to show your company’s business activities have substance in the UAE.

Ultimate Beneficial Ownership (UBO): Keep a register of your actual owners. Update UAE authorities within 15 days of any change.

Anti-Money Laundering (AML): If your business falls under a regulated sector (like real estate or finance), set up AML policies and register with the UAE Financial Intelligence Unit within 60 days of incorporation.

Value Added Tax (VAT): Register for VAT if annual turnover exceeds AED 375,000. File VAT returns quarterly—even when there’s no taxable income.

Not keeping up can mean fines up to AED 100,000, license suspension, or even business closure. Track deadlines carefully and get expert help if you’re unsure.

Visas and Banking: Your Gateway to Operating in Dubai

Once your company formation in Dubai is complete, securing residency visas and opening bank accounts becomes your next priority. These steps are essential for operating your business effectively and maintaining compliance with UAE regulations.

Visa Pathways for Indian Entrepreneurs in 2025

Investor Visa: This standard visa links directly to your company ownership and allows you to live and work in Dubai. Indian entrepreneurs typically receive a 2-3 year investor visa when they establish their UAE company registration. The visa can be renewed as long as your business remains active and compliant.

Golden Visa: The UAE’s most attractive long-term residency option offers 5-10 year validity for qualifying investors. You need a minimum investment of AED 2 million in real estate, public investments, or business ventures.

The 2025 update introduced a nomination-based Golden Visa for AED 100,000 (approximately Rs 23.3 lakh), making it accessible to professionals like scientists, educators, and digital creators. Benefits include family sponsorship, work authorization without employer sponsorship, and tax advantages.

Green Visa: This 5-year self-sponsored visa targets skilled professionals, freelancers, and investors without requiring employer sponsorship. Skilled employees need a minimum AED 15,000 monthly salary and a bachelor’s degree, while freelancers must demonstrate AED 360,000 annual income. The Green Visa offers flexibility to change jobs without affecting your visa status.

The Reality of Opening a Corporate Bank Account

Opening a corporate bank account can be challenging for new businesses. Traditional banks require extensive documentation and often involve lengthy approval processes taking 2-4 weeks.

Standard requirements include your trade license, Memorandum of Association (MOA), passport and visa copies of all shareholders, Emirates ID copies if applicable, and often a detailed business plan with proof of business activity. Banks conduct thorough Know Your Customer (KYC) and Anti-Money Laundering (AML) checks before approval.

Digital-only banks are emerging as viable alternatives, offering faster processing times of 3-5 days. Options like Wio Business, Mashreq NeoBiz, Emirates NBD E20, and Al Maryah Community Bank (Mbank) provide streamlined online applications and competitive features. These digital platforms often have lower minimum balance requirements and reduced paperwork compared to traditional banks.

How Business Setup Consultants Like Firmz Can Help

The Role of a Business Setup Partner

A business setup consultant does more than fill out forms. They handle all the paperwork, talk directly with government departments, and give clear guidance at every step. This support helps you start a business in Dubai from India faster, avoid mistakes, and sidestep costly errors that might delay your progress.

Introducing Firmz

Firmz is a trusted business setup and company formation expert, based in Dubai and operating out of both Dubai and Mumbai. Many Indian entrepreneurs turn to Firmz when they want to open a business in Dubai.

Firmz’s professional team guides you on the best structure for your company—whether you need a mainland, free zone, or offshore setup. We also handle visa processing, open corporate bank accounts, and provide full PRO services to keep your new Dubai company compliant.

Their aim is to make each step easy, so you can focus on growing your business instead of worrying about complex rules. With Firmz, starting company registration in Dubai from India becomes stress-free and straightforward.

Frequently Asked Questions (FAQs)

Can an Indian citizen own 100% of a company in Dubai?

Yes, in most cases. You can have 100% ownership in any of the 50+ free zones and for over 1,000 commercial and industrial activities on the mainland after the 2021 UAE Commercial Companies Law amendments.

What is the minimum investment required to start a business in Dubai?

There is no official minimum investment requirement. Costs depend on your license type, visa needs, and office requirements. A free zone license can start from around AED 12,900, while mainland setups typically begin at AED 25,000.

What is the process for how to start a business in Dubai from India?

The Dubai business setup process involves choosing your business activity and structure, registering a company name, submitting required documents, obtaining your trade license, securing office space, and opening a corporate bank account.

How long does it take to register a company in Dubai?

Timeline varies by jurisdiction and complexity. A Dubai free zone company setup can be completed in 3-7 working days, while mainland company registration typically takes 1-2 weeks depending on document preparation and government processing.

Do I have to pay personal income tax in Dubai?

No, there is currently no personal income tax levied on individuals in Dubai or the wider UAE. However, corporate tax of 9% applies to business profits exceeding AED 375,000 annually.

Final Thoughts

Setting up your UAE company registration from India involves careful planning across multiple areas – choosing the right business structure, budgeting for setup and ongoing costs, and maintaining compliance with both UAE and Indian regulations.

Whether you select a mainland company for maximum trading flexibility or a free zone entity for tax benefits and 100% ownership, each path offers unique advantages for Indian entrepreneurs.

Dubai’s business-friendly environment, combined with strategic location advantages and strong India-UAE economic ties, makes starting a company in Dubai from India an attractive proposition for 2025.

With proper documentation, expert guidance, and understanding of the regulatory landscape, you can successfully establish your presence in one of the world’s most dynamic business hubs.